|

Table of Contents KPSC Accounts Assistant Recruitment 2024 latest vacancy salary syllabus |

|

| Organization | Karnataka Govt Public Service Commission |

| Vacancy name | Accounts Assistant |

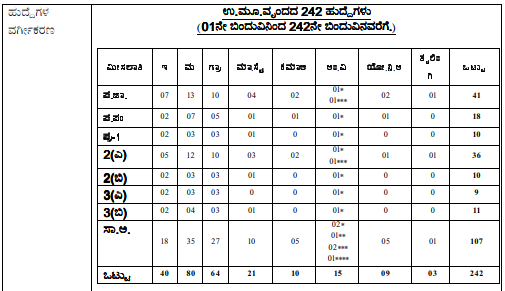

| No of vacancy | 242+ posts |

| Official website | Kpsc.kar.nic.in |

| Location type | Karnataka Government Jobs 2024 |

KPSC Karnataka Accounts Assistant 2024 vacancy details:

| Post type | Vacancy |

| Accounts Assistant | 242+ |

Eligibility Criteria

| Post | Education type |

| Accounts Assistant | B.Com, BBM, BBA (Relevant Discipline) |

| similar | 12thpass jobs / Graduate jobs |

Age limit

| Post | Age limit |

| Accounts Assistant | 18-35 |

Selection process :

- Paper 1: General Knowledge (100 marks, 1.5 hours duration)

- Paper 2: General Kannada or General English (100 marks, 1.5 hours duration)

- Computer Proficiency Test: Candidates who qualify in the written exam are called for the computer proficiency test, which includes:

- MS Word (20 marks)

- MS Excel (20 marks)

- MS PowerPoint (10 marks)

- Email (10 marks)

- Internet (10 marks)

| Papers | Subjects | Total Marks | Number Of Questions | Time Duration | Exam Type | |

| Paper 1 | General Knowledge | 100 | 100 | 90 Minutes | Objective | |

| Paper 2 | General Kannada Language | 35 | 35 | 120 Minutes | ||

| General English | 35 | 35 | ||||

| Computer Knowledge | 30 | 30 | ||||

| Total | 200 | 200 | 210 Minutes | |||

KPSC Karnataka Accounts Assistant Salary pay scale 2024

| Post | salary |

| Accounts Assistant | RS.27,650-52,650 |

Basic salary RS.27,650-52,650 INR, salary in hand will be 2x of basic salary* including allowances Karnataka Govt Public Service Commission gives best (in the market) salary for 2024 Accounts Assistant Recruitment. Candidates are advised to calculate thoroughly and understand the KPSC Karnataka basic salary and salary in hand and net salary in hand by 7th CPC Pay Matrix table.

Application last date * (tentative) KPSC Karnataka Accounts Assistant 2024 vacancy

| vacancy | Start date | Last date |

| Accounts Assistant | 23-03-2023 | 23-04-2023 |

Notification links KPSC Karnataka Accounts Assistant 2024 vacancy

| Vacancy | # Notification | Application form |

| Accounts Assistant | KPSC Karnataka Accounts Assistant Notification 2024 pdf | KPSC Karnataka Accounts Assistant Application form |

kpsc account assistant syllabus

| Kerala PSC Accounts Assistant Exam Pattern | ||

| Parts | Sections | Marks |

| Part I | Accounts | 80 Marks |

| Part II | Computer Application | 20 Marks |

- Introduction to Financial Accounting – Rules Concepts and Conventions. Structure and contents of Financial Statements – Profit and Loss Account & Balance Sheet- Need for adjusting entries – Revenue expenditure- Depreciation, Closing inventories, bad debts- Provision for doubtful debt discounts- Prior year expenses.

- Analysis of financial statements, Ratios, types of ratios, their meaning, and use of ratios to understand the financial status and performance of an organization.

PART I – ACCOUNTS

Module 1: Accounting (8 Marks)

- Financial Accounting- Concepts-Principles- Accounting standards- Accounts for a sole trader- Financial Statements – Final accounts of Sole Trader – Trading and Profit and Loss Account – Balance Sheet –- Partnership Accounts – Admission and Retirement – Dissolution of Partnership Firm- Realisation Accounts and Capital Accounts- insolvency of a partner- accounting for consignment –- Final Accounts of Companies- Computerised Accounting and usage of software in preparation of accounts.

Module 2: Financial Management (8 Marks)

- Financial Management- the cost of capital – financing decision – capital structure – working capital management -Working Capital Cycle – Management of Cash – Receivables management- Inventory management- Dividend policy – Forms of Dividend- Types of Dividend Policies – Factors determining dividend – Theories of Dividend Policies – Stock Splits – Stock Repurchase.

Module 3: Cost Accounting (8 Marks)

- Introduction to Cost Accounting- Accounting and control of material cost-Accounting and control of labour cost- Accounting for overheads— Marginal costing – Standard costing – Breakeven analysis – Cost reduction – Cost management

Module 4: Management (8 Marks)

- Nature and Evolution of Management – Schools of Management Thought- planning- organizing- controlling – directing – staffing – Leadership and Theories – Motivation and Theories – TQM

Module 5: Managerial Economics (8 Marks)

- Demand Estimation – Demand– elasticity of demand – price – income – advertisement – Demand forecasting – Theory of Production – Pricing Policy and Practices- Business cycle

Module 6: Company Law (8 Marks)

- Introduction to Company Law- company management and Administration – Constitution of Board of Directors- – Appointment – functions and Responsibilities of Board of Directors – Board Committees- Audit Committee–Board Meetings- Disclosure and Transparency – Annual Return- Winding Up -Voluntary Winding up Winding Up by National Company Law Tribunal- Winding Up by Liquidators- Procedure for Liquidation.

Module 7: Capital Market (8 Marks)

- Financial System in India- Financial System-Financial market – the structure of the financial market–Capital market instruments – Primary Market – Methods of floatation of capital – Public issue – IPO – FPO – Procedure of public issue – Book building process- Secondary Market – Functions of the stock exchange –Dematerialization of securities –- Major stock exchanges in India – BSE- NSE – Listing – Regulatory framework of financial market

Module 8: Fundamentals of Income-Tax (8 Marks)

- Income Tax Act- Basic Concepts -Assessment Year- Previous Year – Person – Assessee- Income- Gross Total Income- Total Income- Rates of Tax applicable to the Individual Assessee- income from salary- house property- business- capital gain and other sources- computation of total income – deductions and exemptions- tax planning – income tax returns.

Module 9: Marketing Management (8 Marks)

- Marketing of products and services – Consumer Behaviour- Process of Consumer Buying- Factors influencing Consumer Buying Decisions- Customer Relationship Management- Market Segmentation- Product-Meaning – Classification of products- Concept of the product item, product line, and product mix -Product Life Cycle – stages of PLC- Promotion -Concept of push and pull mix-Types of promotion- Advertising- Personal selling, sales promotion, and public relations

Module 10: Auditing (8 Marks)

- Audit Process- Internal Check – Preparation before audit -Audit Programme – audit process -audit notebook – audit working papers – audit files – internal control – internal check- Vouching and Verification- Auditors of Joint Stock Companies- Investigation vs. Auditing.

PART II- COMPUTER APPLICATION (20 MARKS) basic standard

MODULE I- COMPUTER FUNDAMENTALS & INFORMATICS

MODULE II – OFFICE AUTOMATION

MODULE III – PROGRAMMING LANGUAGES

MODULE IV – DATABASE MANAGEMENT SYSTEMS

MODULE V – WEB DESIGNING

hi, i am Raaz Kumar from Hyderabad, working as content creator from 3 years at sarkari result.. expert in govt jobs guidance. Follow me Twitter getluckybyme